Good performance in challenging times

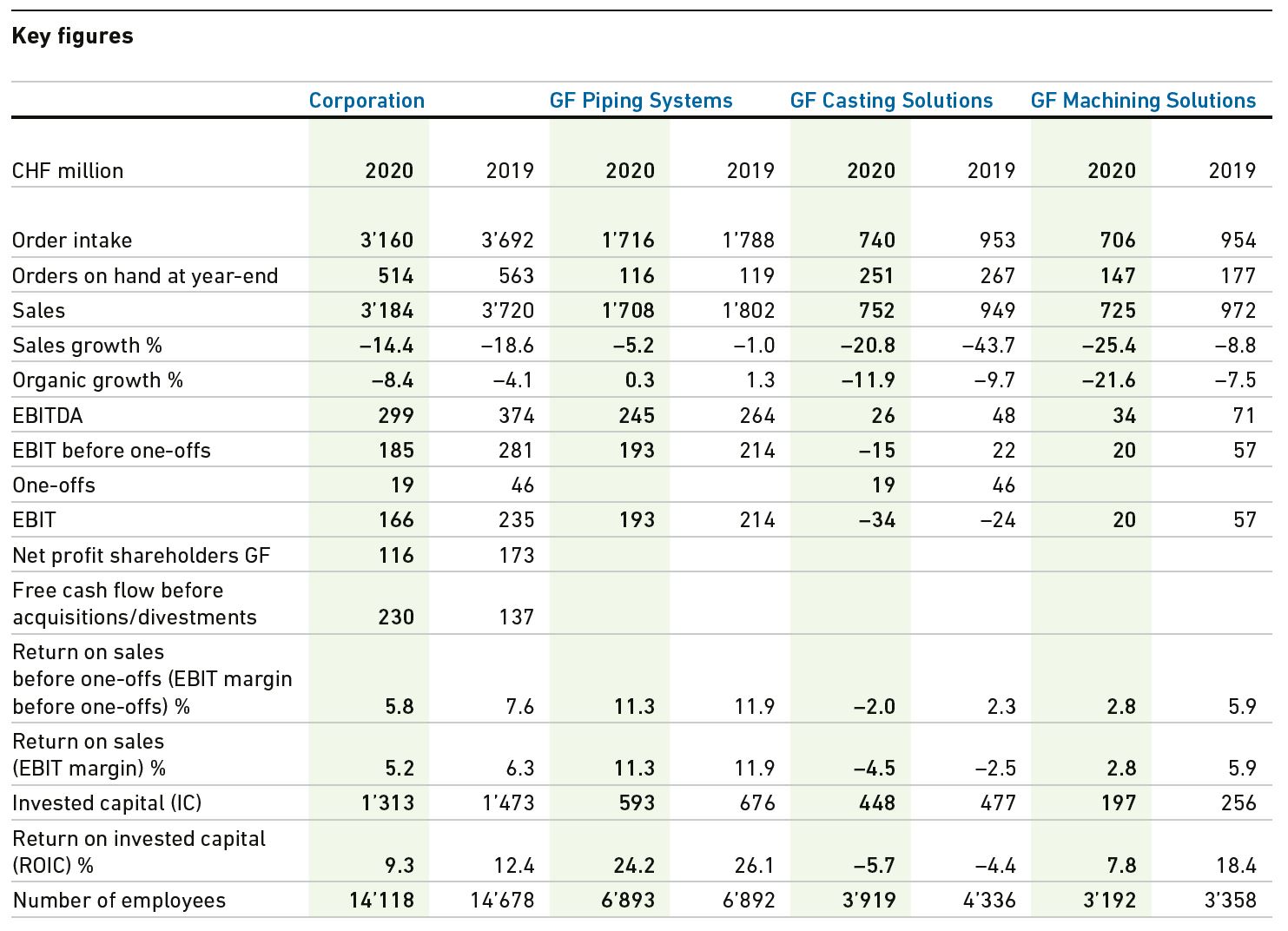

- Sales decreased 14.4% to CHF 3'184 million, organically by 8.4%

- Rebound and stabilization in 2nd half of the year, the operating result (EBIT) doubled compared with 1st half

- Operating result (EBIT) before one-off items of CHF 185 million, reported EBIT of CHF 166 million

- EBIT margin stood at 5.8% before one-off items, 5.2% after one-off items

- Strong free cash flow before acquisitions/divestments of CHF 230 million

- New strategy to accelerate growth with sustainable innovations

2020 has brought about an unprecedented level of uncertainty, with a raging global pandemic that also worsened the already challenging economic environment. People, societies and companies were required to re-invent the way they live and do business – GF was no exception. While the COVID-19 pandemic is still disrupting daily life across the world, GF can count on its strategic positioning, financial stability and innovation focus to overcome the crisis.

Against this rapidly shifting backdrop, the commitment and determination of our employees has been a key success factor. They showed perseverance, dedication, teamwork, as well as a willingness to be there for our customers even in difficult times. All our employees – whether in production, logistics or in their offices – have quickly adapted to the new situation. With great agility, they adjusted to more challenging working conditions and new digital tools. This deserves our utmost gratitude and recognition. Our thanks also go to our customers, who are breaking new ground in the way they interact and communicate, together with us.

GF reported a clearly stronger performance in the second half of 2020, compared with the first half and in spite of the fact that some of the challenges of the previous year persisted. Among these were the trade tensions between the US and China and more political turmoil, including in the US and Europe, as well as the ongoing transformation of the automotive industry. GF reacted quickly to the new risk landscape, diversifying activities and further increasing its resilience.

GF sales in 2020 amounted to CHF 3'184 million (2019: CHF 3'720 million). The difference when compared with the previous year mostly reflects the impact of the continued tightening of COVID-19 restrictions in many countries around the world. Organically, sales decreased by 8.4%, despite a resilient piping market and the recovery of the global automotive market in the second half of the year. Negative currency effects weighed heavily on sales, with an impact of more than CHF 170 million. GF Piping Systems was mostly affected (CHF 103 million).

The operating result (EBIT) before one-off items amounted to CHF 185 million (2019: CHF 281 million) and the reported EBIT was CHF 166 million (2019: CHF 235 million). The corresponding EBIT margins were 5.8% (2019: 7.6%) and 5.2% (2019: 6.3%). The one-off items in 2020 of CHF 19 million (2019: CHF 46 million) are exclusively related to the partial relocation of a foundry in Werdohl (Germany), which is mostly finished at year-end. In 2020, the EBIT before one-off items and the reported EBIT included the gain from the sale of a building by GF Machining Solutions of CHF 10 million.

The return on invested capital (ROIC) reached 9.3%, with a remarkable 24.2% achieved at GF Piping Systems. At the end of 2020, GF employed 14'118 people, compared with 14'678 employees at year-end 2019, with the largest change occurring in GF Casting Solutions as a consequence of the strategic transformation of the division.

In 2020, GF secured liquidity through both its global business activities and financing transactions, resulting in a high level of liquidity and a low net debt ratio below 0.5 at the end of the year. GF also reported a strong balance sheet, with a solid equity ratio of 40%.

Net profit attributable to shareholders amounted to CHF 116 million (2019: CHF 173 million). Free cash flow before acquisitions reached a very strong level at CHF 230 million, CHF 93 million above last year's result. Earnings per share were CHF 28 (2019: CHF 42). At the upcoming Annual Shareholders' Meeting, the Board of Directors will propose a dividend per share of CHF 15 (2019: CHF 25 per share), also in light of the strong free cash flow and the good position of GF in its markets.

GF is continuously shifting its focus on less cyclical market segments, thus increasing its resilience to economic fluctuations. All three divisions address needs stemming from global mega-trends, such as having enough clean water to cater to a growing global population, lighter car components to reduce carbon emissions, or high precision parts to reduce energy consumption.

GF Piping Systems

As a leading flow solutions provider enabling safe and sustainable transport of fluids, GF Piping Systems was able to maintain operations at a high level also during the COVID-19 pandemic, as most of the division's sites were declared essential businesses. The ongoing focus on higher value businesses and digitalized solutions, together with a broad customer base in diversified market segments, have further increased the division's resilience. Sales at GF Piping Systems amounted to CHF 1'708 million, a reduction of CHF 94 million compared with the previous year. Adjusted for the negative currency effects of CHF 103 million, organic growth was positive at 0.3%. EBIT was CHF 193 million, compared with CHF 214 million in the previous year. EBIT margin came in at a strong 11.3%, slightly below last year's EBIT margin of 11.9%.

Sales of the division's customized solutions, data center as well as its microelectronic segments remained strong globally. Sales were also strong in Asia, in particular China, Korea and Japan, while in the Americas, sales were impacted by the low activity in the utility business.

GF Piping Systems continued to build on its strategy to expand its global presence. Another promising step into the large South American market is the acquisition of the leading piping systems manufacturer FGS Brasil Indústria e Comércio Ltda. (FGS), based in Cajamar (Brazil).

With two production sites now in the country and an already existing partnership, GF Piping Systems can benefit not only from the government initiative to improve water and gas distribution across Brazil, but also from growth opportunities in neighboring markets.

GF Casting Solutions

2020 saw GF Casting Solutions become a true global player, with an international production footprint, and a focus on lightweight components as part of the division's increasingly important role in the area of sustainable mobility.

The performance of GF Casting Solutions was impacted, however, by several lockdowns during the pandemic, which led to a slump in orders in both the automotive and the aerospace business. During the first pandemic peak in early 2020, the division faced a complete production standstill lasting several weeks.

On the other hand, the ongoing transformation of the automotive industry to hybrid and e-vehicles supported the business, together with other structural and operational measures that were quickly implemented. Orders for hybrid and e-vehicles reached 32% of total orders, a clear reflection of GF Casting Solutions' competence in this area. Orders in the last quarter of 2020 increased rapidly, an indication of the recovery of the business.

Sales were down by 11.9% (organically) to CHF 752 million from CHF 949 million in the previous year. The significant reduction of the business led to a negative EBIT before one-off-items of CHF -15 million (2019: CHF 22 million) and a negative reported EBIT of CHF -34 million (2019: CHF -24 million). The relocation of the casting site in Werdohl (Germany) was mostly finished at year-end and the related one-off items amounted to CHF 19 million (2019: CHF 37 million). The ramp-up of the new light metal foundry in Mills River (US) was negatively affected by the lockdown measures. With the construction of the new light metal foundry in Shenyang (China), GF Casting Solutions is clearly expected to benefit from the positive development of the Chinese automotive market, especially in light of the growing hybrid and e-vehicle demand. The construction is proceeding according to schedule, with the start of production foreseen for 2022. The division also already won its first orders for this site.

GF Machining Solutions

The 2020 global machine tool business was hit by the general downturn in the capital goods market, which began in the second half of 2019 and further deteriorated with the COVID-19 impact. In 2020, the demand for machine tools sank to a minimum in Europe, as well as in several markets in the Americas. Most of the orders from the aerospace sector were postponed, and new orders remained at a very low level. The attractiveness of this market segment clearly remains high from a long-term perspective.

The second semester of 2020 showed signs of recovery, especially in China, with an increase in orders after the lockdown was lifted. Projects in Europe increased in the last quarter of 2020, leading to higher order intakes than in the previous quarters.

Sales dropped to CHF 725 million, a decrease of 25% compared with the previous year. Taking into account the negative foreign currency impacts of CHF 36 million, the organic decline was 22%. The lower sales also affected the operating result, which stood at CHF 20 million (2019: CHF 57 million), resulting in an EBIT margin of 2.8%, compared with 5.9% in 2019. Included in the operating result is the gain from the sale of a building in Switzerland of CHF 10 million. Med-tech and ICT remained relatively stable, while other segments lagged behind the levels of the previous year to a larger extent. With a growing backlog and increasing demand in important markets such as Germany and China, GF Machining Solutions showed clear signs of recovery in the last quarter of 2020.

Strategy 2016–2020 cycle ends

GF withstood the impact of COVID-19 thanks to its successful multi-year portfolio transformation and solid financing situation. GF Piping Systems now accounts for more than a half of GF's sales. In the course of the last strategy cycle (2016-2020), several acquisitions and partnerships in all divisions, but in particular the strategic transformation of GF Casting Solutions, increased the resilience of the business portfolio. In line with the strategic targets, GF also reduced its dependency on the European market to a share of less than 50% of sales and improved its customer-centric innovation approach.

GF ended the strategy cycle with a strong rebound in China for all three divisions and an outstanding contribution of GF Piping Systems. The Corporation is well positioned to benefit from positive long-term market trends. We also see positive momentum for sustainability-driven segments and durable applications, such as safe water distribution, lightweight structural parts for passenger cars, and laser technologies replacing, for example, harmful chemical solutions.

Strategy 2025 to accelerate profitable growth with sustainable innovations

The Strategy 2025 will build on the promising path pursued over the last five years and will address profitable growth, portfolio resilience, and a "go for the full potential" spirit within the Corporation, in line with GF's overall strategic objective to grow through superior customer value. These are GF's strategic focus areas:

Drive profitable growth through intelligent and sustainable solutions: Accelerate product/solution development through more focus, firm resource commitments, and effective collaboration with customers and business partners. With our intelligent solutions, we will address the pain points and, in particular, the sustainability needs of our customers in a comprehensive way. For example, GF Piping Systems will develop automated flow solutions to reduce non-revenue water or enable safe hygiene processes; GF Casting Solutions will design and produce complex lightweight casting components; GF Machining Solutions will focus on intelligent multi-technology process integration to serve the demanding automation and precision needs of tomorrow.

Increase robustness through portfolio additions and operational excellence: Intense focus on resilient segments such as water treatment, data centers, hybrid/electric vehicles, medical devices, and more.

Evolve into a performance and learning culture: To shift towards a more "performance" and "learning"-driven mind-set. Agility and adaptability become a prerequisite for success in a rapidly changing world. Dedicated programs will support this important cultural shift. In terms of financial targets, the strategic ambition is to achieve sales of CHF 4.4 (organic) to 5 billion (incl. acquisitions) with an EBIT margin of 9-11% and a return on invested capital (ROIC) of 20-22% by 2025. The share of GF Piping Systems will remain at least 50% and GF will continue to invest predominantly in growth markets.

A more sustainable future

At GF, we believe that sustainability is not just about doing the right thing. It is a concrete opportunity to reshape our industry and drive profitable growth. That is why GF is set to become a leader in the sustainability and innovation fields in its business, and use its products and solutions to support clients on their own journeys. For example, GF's lightweight components enable the automotive industry to reduce carbon emissions while increasing energy efficiency; GF's piping systems mitigate water losses. The company's efforts were also recognized externally. In 2020, a leading newspaper ranked GF as one of the ten most sustainable companies worldwide. The rating, based on the examination of 5'500 companies, considers aspects such as business model and innovation, social and human capital, and the environment. GF scored high in the human capital dimension.

The successful rating underscores GF's efforts to meet its Sustainability Targets 2020. Sustainability is an integrated key pillar of our new strategy cycle. To better embed sustainability into our management, we formed a new Sustainability Committee within our Board of Directors, strengthening our Environmental, Social and Corporate Governance (ESG) focus at the highest company level.

2021 Outlook

GF is well positioned to continue its recovery trend in 2021, building on the positive momentum of the last quarter of 2020. The current year already saw a good order intake and a promising rebound in key markets, especially in China. Despite the persistent uncertainty due to the COVID-19 pandemic, we expect sales growth in the mid to high single digits, as well as an increase in profitability, barring unforeseen circumstances and provided the stringent lockdown measures across the world will be relaxed in the course of the first half of 2021.

The full version of the Annual Report 2020 is available at www.annualreport.georgfischer.com/2020/en.

GF uses certain key figures to measure its performance that are not defined by Swiss GAAP FER. For that reason, there might be limited comparability to similar figures presented by other companies. Additional information on these key figures can be found on

www.georgfischer.com/en/investors/alternative-performance-measures.html

The presentation of the annual results will take place on 3rd March via Video Webcasts:

- For journalists at 10:30 am – please use the following link.

- For analysts at 1:45 pm – please use the following link.

Good performance in challenging times

Good performance in challenging times

CEO Andreas Müller and CFO Mads Joergensen, speaking at the Annual Media Conference on 3rd March 2021, in Zürich

CEO Andreas Müller and CFO Mads Joergensen, speaking at the Annual Media Conference on 3rd March 2021, in Zürich

CEO Andreas Müller speaking at the Annual Media Conference on 3rd March 2021, in Zürich

CEO Andreas Müller speaking at the Annual Media Conference on 3rd March 2021, in Zürich

CFO Mads Joergensen speaking at the Annual Media Conference on 3rd March 2021, in Zürich

CFO Mads Joergensen speaking at the Annual Media Conference on 3rd March 2021, in Zürich

CFO Mads Joergensen speaking at the Annual Media Conference on 3rd March 2021, in Zürich

CFO Mads Joergensen speaking at the Annual Media Conference on 3rd March 2021, in Zürich

Annual Media Conference on 3rd March 2021, in Zürich

Annual Media Conference on 3rd March 2021, in Zürich

- 0

- 1

- 2

- 3

- 4

- 5

GF – with its three divisions GF Piping Systems, GF Casting Solutions, and GF Machining Solutions – offers products and solutions that enable the safe transport of liquids and gases, as well as lightweight casting components and high-precision manufacturing technologies. As a sustainability and innovation leader, GF strives to achieve profitable growth while offering superior value to its customers for more than 200 years. Founded in 1802, the Corporation is headquartered in Switzerland and present in 34 countries with 139 companies, 61 of which are production facilities. GF's 15'111 employees worldwide generated sales of CHF 3'722 million in 2021.